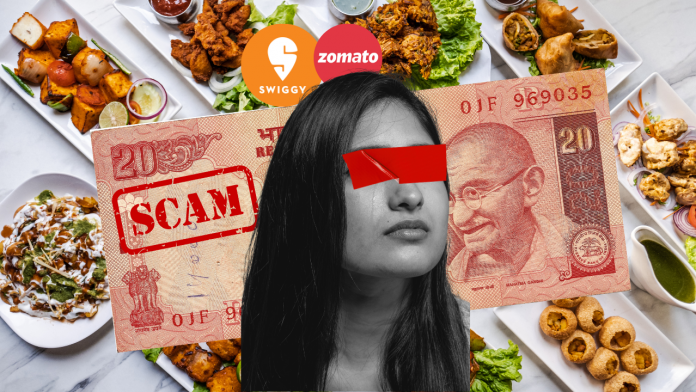

Business Today has reported that some delivery partners on popular platforms like Swiggy and Zomato have allegedly been exploiting a loophole that is starting to cause significant damage to the food delivery ecosystem. The scam involves delivery workers marking an order as “undelivered,” triggering an automatic refund to the customer.

However, the delivery person still shows up with the food and asks the customer to pay them directly. Since the order is marked as cancelled, the full payment ends up with the delivery partner, with no share going to the restaurant or the platform.

Continue Exploring: Lahori Beverages Nears ₹450 Crore Fundraise as Valuation Soars to ₹2,500 Crore – A New Challenger in India’s Booming Drinks Market

While this may seem like a small hustle for those who typically earn ₹15–₹20 per order, it’s far from harmless. Restaurants are losing both payment and inventory, and the platforms’ data integrity is compromised. Meanwhile, honest delivery workers face increased suspicion.

One of the key problems with this scam is the lack of any traceable evidence. Without receipts or any formal accountability, the fraudster walks away with cash, leaving no record behind. This creates a dangerous precedent, as it not only impacts individual businesses but also undermines the entire food delivery system. Restaurants, many of which operate on tight margins, suffer losses, and customers are misled. On top of that, the platforms are left grappling with unreliable data.

Continue Exploring: “Kuch Nahi Hoga”—Anupam Mittal Challenges This Dangerous Mindset in Policy Bazaar’s New Ad

If this behavior spreads, it could have even wider implications. Restaurants may begin to question their association with these platforms, knowing that their earnings could disappear without a trace. This growing issue threatens the trust that underpins the entire food delivery model.

The ramifications of this fraudulent behavior go beyond harming individual businesses; it could ultimately damage the reputation of the entire food delivery industry.