McDonald’s Australia is set to open a new restaurant at Brisbane Airport’s Domestic Terminal in mid-2024.

Planned to be situated in a food court across from Gate 41, the upcoming restaurant will showcase kiosks, offering guests enhanced convenience and speed.

The restaurant company anticipates that the upcoming initiative will infuse A$7 million ($4.4 million) into the local economy and generate employment opportunities for 100 individuals.

Additionally, the upcoming restaurant will include a McCafé, expanding the array of choices available to customers.

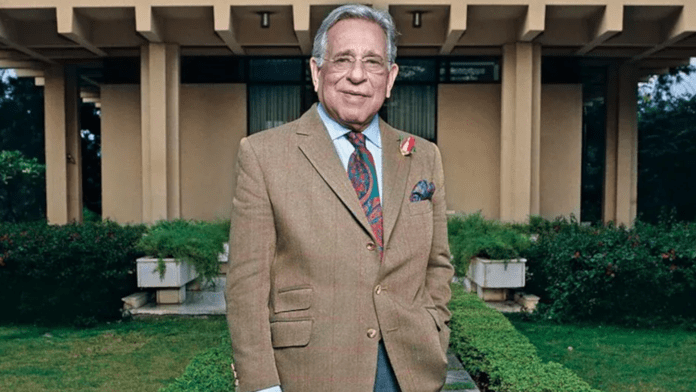

McDonald’s Australia North Region regional director Alex Carapetis said, “We are excited to open our doors on McDonald’s Brisbane Airport Domestic and provide a space for travellers to enjoy a meal or coffee while they move through the airport.

“Every McDonald’s restaurant is committed to supporting the local community through providing jobs, training and development opportunities. We’re currently hiring a variety of crew, barista, management and maintenance roles in restaurants right across Brisbane.”

“We are passionate about supporting the professional development of our people and providing workplace skills applicable to any career, so apply today to join the crew.”

The planned McDonald’s location is part of Brisbane Airport’s terminal redevelopment plan.

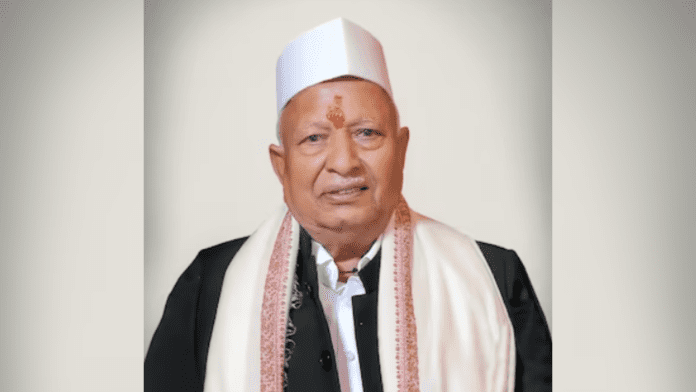

Brisbane Airport commercial executive general manager Martin Ryan said, “If there is one thing BNE travellers have been asking for, it’s a Maccas. It has consistently remained the most requested retailer and we couldn’t be more delighted to deliver.

“The terminal redevelopment is part of the $5bn Brisbane Airport is investing in Future BNE.

“This stage of the project will deliver new and revamped food and beverage experiences, upgraded amenities and fresh gate lounge seating areas for passengers while they wait for their flights.”