Wahter, the renowned packaged drinking water brand from India, has launched its exclusive carts throughout the National Capital Region (NCR), marking a notable change in the availability of economical drinking water. Targeting students, youngsters, and underserved communities, Wahter provides its top-notch bottled water at an impressive 80 percent markdown compared to current market prices.

Wahter’s commitment to making clean drinking water accessible and affordable is clear from its pricing approach, with bottles priced at INR 1 for 250 ml and INR 2 for 500 ml. The goal is to guarantee access to safe drinking water for all residents of the NCR, irrespective of their socio-economic circumstances.

Continue Exploring: At just INR 1 per bottle, Wahter shakes up India’s bottled water industry with game-changing approach

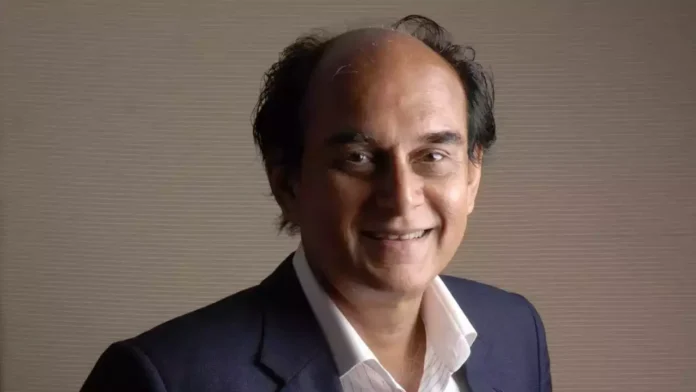

Amitt Nenwani, Co-Founder of Wahter said, “These carts represent more than just a distribution mechanism; they symbolize our dedication to democratizing access to clean drinking water. By offering our branded packaged drinking water at significantly reduced prices, we are empowering individuals in every corner of the NCR to have equitable access to water.”

Strategically, Wahter has positioned its exclusive carts and strollers in key locations throughout the NCR, such as Advant in Noida, India Gate, and Huda Sector 44 in Gurgaon, offering packaged drinking water at an impressive 80 percent discount.

In an effort to broaden its audience, Wahter has initiated a captivating advertising campaign on the SonyLIV Channel, aired during episodes of Shark Tank India. The brand’s dedication to accessibility is reinforced through partnerships with organizations like the Shoobhi Foundation (BOAT CSR) and Vijay Sales.

As Wahter leads the way in innovation within the packaged drinking water industry, it remains unwavering in its commitment to ensuring that clean and safe drinking water is within reach of every person, thereby fostering a healthier and fairer society.

Additionally, Wahter underscores its commitment to sustainability by teaming up with Scrapbuddy to gather and repurpose used bottles. Setting an ambitious target, the company aims to recycle 10 million bottles into clothing within the coming three months.

Continue Exploring: Wahter and Scrapbuddy join forces to recycle 10 Million PET bottles in Delhi-NCR