In India’s fiercely competitive aviation market, where fares often dictate choice, airlines are increasingly turning to experience-led differentiation. Akasa Air is the latest to lean into this strategy, unveiling the fourth edition of its Holi Special Meal under its onboard dining service, Café Akasa.

Available from March 1 to March 31 across the airline’s network, the limited-period festive platter is designed to coincide with the spring festival of colours. The pre-bookable offering features Club Kachori with Dum Aloo, accompanied by Thandai gujiya and a beverage of choice—bringing traditional Holi flavours to 30,000 feet.

Building Emotional Connect Through Food

The initiative reflects a broader industry trend where airlines curate culturally resonant onboard experiences, particularly during peak festive travel periods. By incorporating dishes associated with Holi celebrations, Akasa Air aims to evoke familiarity and nostalgia, enhancing the in-flight experience beyond functional travel.

Passengers can pre-order the festive meal through the airline’s website and mobile application, reinforcing the carrier’s digital-first approach to ancillary services.

A Pattern of Seasonal Curation

Since launching operations in August 2022, Akasa Air has consistently positioned curated seasonal menus as a brand differentiator. Café Akasa has previously introduced festival-themed offerings around Makar Sankranti, Eid, Onam, Ganesh Chaturthi, Diwali, and Christmas. The airline also allows travellers to pre-select cakes from its regular menu to celebrate birthdays onboard—small experiential additions aimed at fostering emotional engagement.

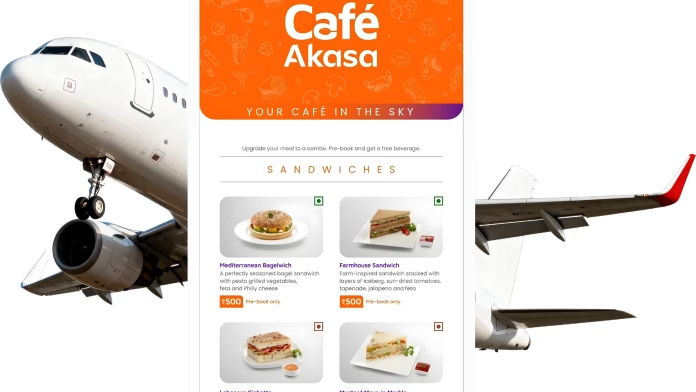

The broader Café Akasa portfolio now features over 45 meal options, including regional Indian specialities, fusion dishes, snacks, and desserts. According to the airline, menu development involves collaborations with chefs from across the country, underscoring its focus on culinary diversity.

Beyond Price Wars

For a relatively young airline navigating a price-sensitive domestic market, festive menu launches may appear incremental. However, as competition intensifies and differentiation becomes harder to sustain through pricing alone, culturally meaningful gestures are emerging as subtle yet effective tools to cultivate brand affinity and long-term loyalty.

In a sector where margins are thin and choices abundant, even a thoughtfully curated festive meal can help an airline stand out—one nostalgic bite at a time.