Rahul Paul, Creative Director at Blinkit, recently took to LinkedIn to share an image that perfectly captures the brand’s witty and functional approach to branding. The post, featuring a Blinkit delivery vehicle, highlights how the company is creatively positioning itself in the quick-commerce industry while engaging with audiences in a lighthearted manner.

Continue Exploring: The End of a Retail Era: Neville Noronha Checks Out, Anshul Asawa Checks In

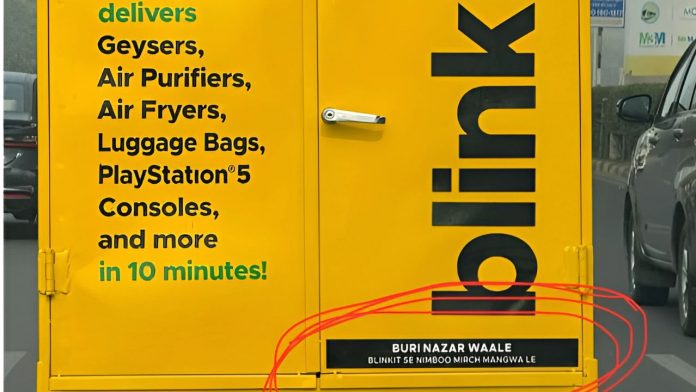

The image showcases a bright yellow Blinkit large-order delivery vehicle, which stands out not just because of its bold color but also due to the clever messaging on its exterior. The vehicle’s side panel emphasizes Blinkit’s ability to deliver not just everyday groceries but also larger items such as geysers, air purifiers, air fryers, luggage bags, and even PlayStation 5 consoles—all in just 10 minutes! This highlights the company’s increasing focus on expanding its product offerings beyond essential groceries and into the realm of high-value, large-sized products.

However, what truly caught people’s attention was the humorous and culturally relevant text placed on the back of the vehicle. It reads: “Buri Nazar Waale, Blinkit Se Nimboo Mirch Mangwa Le”, which translates to “Evil eye watchers, order lemons and chilies from Blinkit.” This is a playful nod to the widely followed Indian superstition of hanging lemons and chilies to ward off the evil eye. The phrase instantly connects with the local audience, reinforcing Blinkit’s knack for blending cultural insights with its branding strategy.

Continue Exploring: NONSTOP launches first flagship store in Mumbai, offering mobility and wellness solutions

Rahul Paul’s caption, “Putting the ‘fun’ in functional branding for the Blinkit large order fleet ✌️”, aligns perfectly with Blinkit’s brand personality—modern, fast, and witty. The post resonated with many LinkedIn users, garnering 119 likes, 7 comments, and 1 share at the time the screenshot was taken. The engagement on the post signifies how branding that strikes a balance between practicality and humor can capture consumer interest and create buzz.

Blinkit has consistently leveraged quirky marketing and localized humor to differentiate itself in the competitive quick-commerce space. This latest branding move further cements its reputation as a brand that understands its audience, delivers convenience, and adds a touch of fun to everyday shopping.