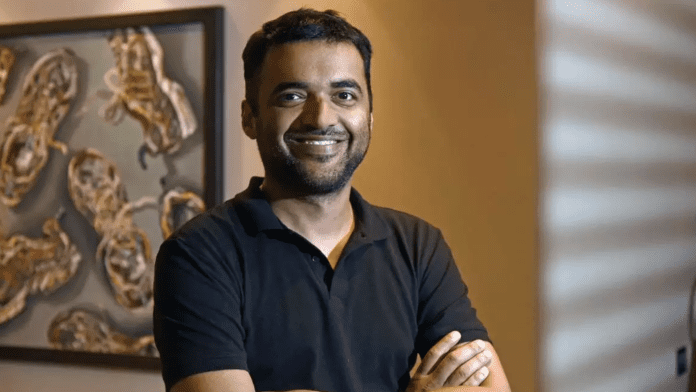

Deepinder Goyal, the Co-Founder and CEO of Zomato, has been allotted 33,422 shares in the public issue of Honasa Consumer, the parent company of the beauty direct-to-consumer unicorn Mamaearth.

According to a source cited by Moneycontrol, data on the bid-allottees for the IPO indicated that Goyal applied for 3.08 lakh Mamaearth shares, but he was allotted only 33,422 shares.

This development coincides with Mamaearth’s scheduled listing on the stock exchanges on November 7. The company successfully raised INR 765.2 crore from 49 anchor investors on October 30.

Read More: Honasa’s Mamaearth IPO attracts INR 765.2 Crore from anchor investors ahead of IPO launch

The funding round garnered support from notable investors, such as Smallcap World Fund, Fidelity, Abu Dhabi Investment Authority, Government Pension Fund Global, Caisse De Depot ET Placement, FSSA India Subcontinent Fund, Carmignac Portfolio, Goldman Sachs, Hornbill Orchid India Fund, and others.

On the final day, Mamaearth’s public offering was oversubscribed by 7.61 times due to substantial demand from qualified institutional buyers (QIBs). The issue attracted bids for 22 crore shares compared to the 2.89 crore shares available. Specifically, 1.57 crore shares were allocated for the QIB category, but it received bids for 18.11 crore shares, resulting in an oversubscription of 11.5 times.

Read More: Mamaearth’s IPO sees remarkable 7.61x oversubscription, fueled by strong demand from QIBs

In total, foreign institutional investors (FIIs) submitted bids for 14.88 crore shares. Conversely, the non-institutional investors (NIIs) category was oversubscribed by 4.02 times by the close of the final day. Out of the 78.72 lakh shares available in this category, it received bids for 3.17 crore shares.

Interestingly, Goyal’s allocation of the D2C unicorn’s shares coincides with the relatively lower interest shown by retail investors in Mamaearth’s IPO. The segment designated for them was oversubscribed by a modest 1.35 times. Retail investors bid for 70.67 lakh shares compared to the 52.48 lakh shares available in that category.

The startup intends to generate a maximum of INR 1,700 crore through its IPO, valuing the company at $1.2 billion. Mamaearth’s public offering consists of a fresh share issue amounting to INR 365 crore and an offer for sale (OFS) comprising 4.12 crore shares. The price range for the IPO was established at INR 308 to INR 324 per share.

Read More: Mamaearth parent Honasa Consumer to launch IPO on Oct 31, targeting INR 10,500 Cr valuation

Established in 2016 by Varun and Ghazal Alagh, Honasa Consumer, the holding company of Mamaearth, encompasses four brands in the beauty and personal care sector: The Derma Co., Ayuga, Aqualogica, and Dr. Sheth’s.

Following its listing, the company will be the fifth new-age tech startup, joining the ranks of ideaForge, Yudiz, Zaggle, and Yatra, to make its debut in the public markets this year.