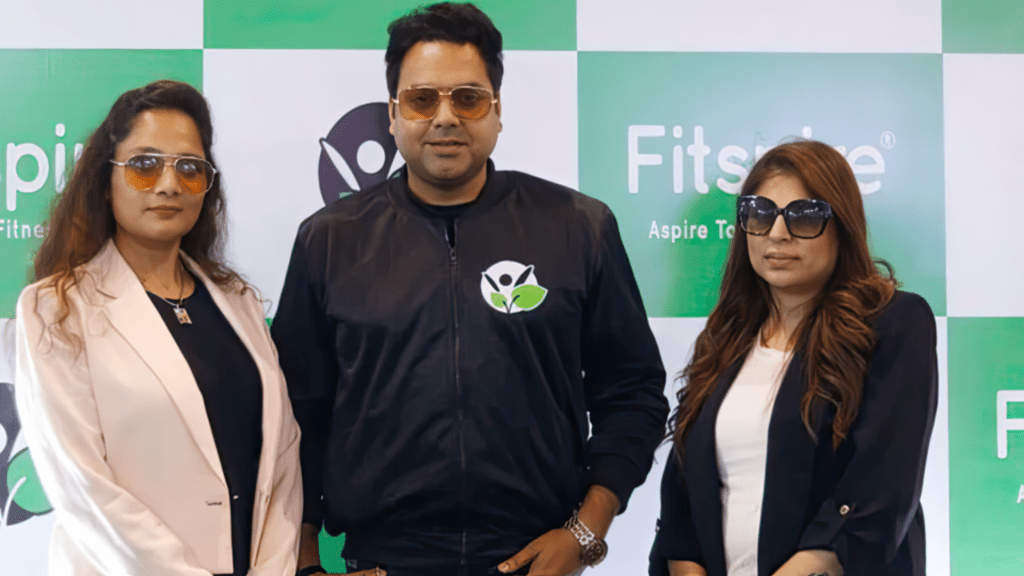

Sukhbir Singh, the renowned Bollywood singer, has made an undisclosed investment in the Pre-Series A funding phase of Fitspire, a startup focusing on vegan healthcare and personal care products.

The funding round also witnessed involvement from Ashish Chand and Sohil Chand of LC Nueva, Ivor Braganza from Next5 Ventures Oman, Dheeraj Jain from Redcliffe London, the Family Office of Jaipurias (represented by Ruchirans Jaipuria and Anuraag Jaipuria), along with the continued participation of existing investor Amit Singhal.

Established in the year 2020 by Vipen Jain, Fitspire is situated in Delhi and tackles present-day lifestyle challenges by providing nourishing dietary supplements. The company asserts its customer base to exceed 1 million individuals, supported by a community of 10,000 fitness influencers. Prior to this, Fitspire had secured $1 million in earlier seed and bridge funding rounds.

With a track record of multiplying sales by tenfold annually, the startup has established an ambitious goal of achieving INR 300 crore in revenue within the upcoming three years.

The raised capital will be allocated towards enriching the Health and Personal Care (HPC) ecosystem, extending its presence across India and global markets, introducing fresh product offerings, and creating novel avenues for generating revenue.

Following the pandemic, there has been a noticeable increase in the inclination of Indian consumers towards selecting fitness and health supplements. This upsurge has consequently attracted significant investor focus towards startups operating within this domain.

In the earlier part of this year, HealthifyMe secured $30 million during its pre-Series D funding round, spearheaded by LeapFrog Investments and Khosla Ventures. During July, prominent FMCG company Marico announced its intention to procure a controlling interest (58%) in the direct-to-consumer nutrition label Plix, for a sum of INR 369.01 Crores.

Last year saw Wellbeing Nutrition secure $10 million in its Series B funding round, with Hindustan Unilever Limited and Fireside Ventures taking the lead in the investment.

Fitspire states that the market’s astonishing valuation stands at $140 billion, with the nutraceuticals sector accounting for $39 billion of this total. Projections indicate that both segments are anticipated to experience a compounded annual growth rate (CAGR) of 18%.