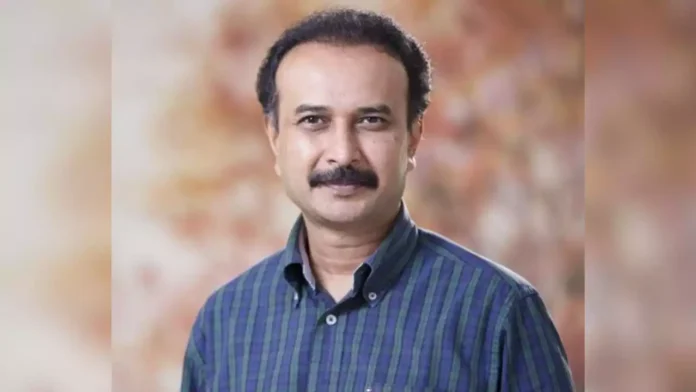

Online-first Direct-to-Consumer (D2C) brands have a significant opportunity to extend their presence by expanding into offline stores, as highlighted by Prashanth Prakash, founding partner at venture fund Accel.

Around 90% of the Indian retail market is projected to remain offline, even as it reaches a size of $2.2 trillion by 2030, according to a joint report on omnichannel firms by Accel, Fireside Ventures, and market research firm Redseer.

Prakash mentioned, “Currently, we have around 100 digital brands generating approximately INR 100 crore, and they stand to gain from the experiential wisdom of transitioning into offline markets… Moreover, the timeframe to achieve a INR 1,000 crore brand status, in my view, has been nearly halved from the previous estimate of 15 years.”

The joint report indicated a significant trend towards omnichannel purchases among Indian consumers. Many prominent brands such as Nykaa, Lenskart, Mamearth, and Caratlane are adopting an omnichannel approach, leveraging exclusive brand outlets to enhance brand visibility and boost sales.

Continue Exploring: D2C brands shell out 30-45% commission for quick-commerce platform listings

Nonetheless, Prakash emphasized that Direct-to-Consumer (D2C) brands ought to maintain their online-first approach. This strategy allows them to iterate swiftly around product-market fit and brand development compared to pursuing an offline route. Once these brands achieve a certain scale and brand recognition, they can consider offline expansion to enhance sales.

Prakash noted that venture firms like Accel and Fireside Ventures are placing their bets on the technology that will facilitate the transition of online-first brands into offline spaces. This technological support will enable new-age brands to expand offline with greater efficiency and assertiveness.

“This opportunity differs from that of legacy players because, unlike before, there’s no need to develop separate brands for urban and rural markets… In the US, one can focus solely on the top 10 metros and establish a $300-400 million brand, but in India, the demand for quality products extends far beyond the metros. In our view, it’s a play across 110 cities,” remarked Prakash.

Additionally, omnichannel brands are dedicating more resources to establish physical stores in non-metro areas. Prakash noted that these brands are discovering favorable conditions, including reasonable rental rates, strong demand economics, and quicker returns on retail investments, particularly in cities like Indore, Lucknow, Coimbatore, and others.

In these markets, a physical presence could significantly enhance the likelihood of “converting” customers by fostering brand awareness and trust.

“I believe there will be a notable rise in experiential purchasing in these towns compared to urban areas, where convenience is often prioritized. The investment in capital expenditure and the management complexity associated with operating numerous outlets across multiple cities are justified,” stated Prakash.

Continue Exploring: Survey finds 80% of D2C businesses yet to achieve profitability; only 12% report profits