Hungry Hawk, the newest dining destination in Hyderabad, has finally opened its doors, promising an unmatched culinary experience with a selection of global cuisine. Positioned in a prime location, it has quickly become the go-to spot for foodies in search of an exceptional dining adventure.

With a diverse array of dishes from Asia, Mughlai, and beyond, Hungry Hawk offers a world of flavors to satisfy every palate. From the savory delights of Japanese Teppanyaki and the aromatic spices of Indian cuisine to the comforting tastes of classic Italian pasta and the indulgent Thai curries, the restaurant ensures a gastronomic journey like no other.

As food enthusiasts step into this multi-cuisine haven, they are greeted with a menu that boasts a tantalizing selection of culinary delights from different corners of the globe. Hungry Hawk aims to be a place where flavors blend seamlessly, creating an unforgettable dining experience for all who walk through its doors.

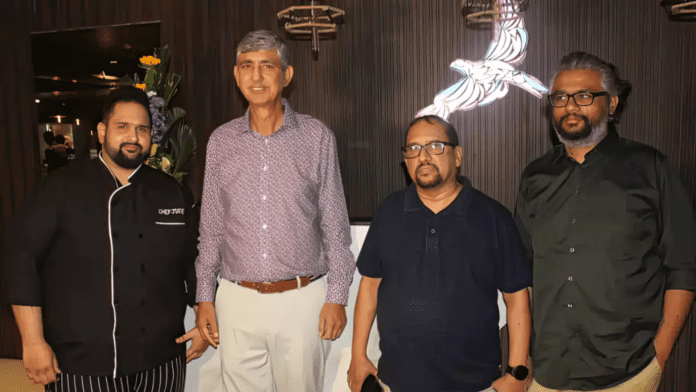

Speaking on the launch, P V Suresh Kumar, Managing Partner, Hungry Hawk, said, “At Hungry Hawk, we set out to design a place that combines two of our personal passions: fine dining and gaming entertainment. Our aim is to offer a singular experience where visitors may savour exquisite cuisine from all around the world while immersing themselves in the excitement of gaming. We are eager to welcome both foodies and gamers. We are committed to using only the finest and freshest ingredients to create our culinary masterpieces. Our talented chefs employ their expertise to craft each dish with passion and precision, ensuring an unforgettable dining experience.”

Adding more to it Sanjeev Dhawan, Managing Partner, Hungry Hawk, said, “Our team of talented Chefs have designed some amazing set menu’s to craft each dish with passion and precision. In order to satisfy the varied palates of our customers, we have taken great care in curating a range of dishes that combine creative flavours by special preparation methods and artistic presentation.

Jude Pereira, Executive Chef, Hungry Hawk, added, “I am pleased to present the Hungry Hawk menu. Each dish has been thoughtfully crafted to showcase the finest flavours and ingredients as the apex of my enthusiasm for culinary creation, promising an unparalleled culinary experience that blends the best of Teppanyaki, Mughlai, and Asian flavours under one roof.”