French bakery chain Paul Depuis 1889 has unveiled its latest venture in Mumbai’s Phoenix Palladium, as revealed by a mall official’s social media update. This establishment stands as the bakery chain’s debut store in the city.

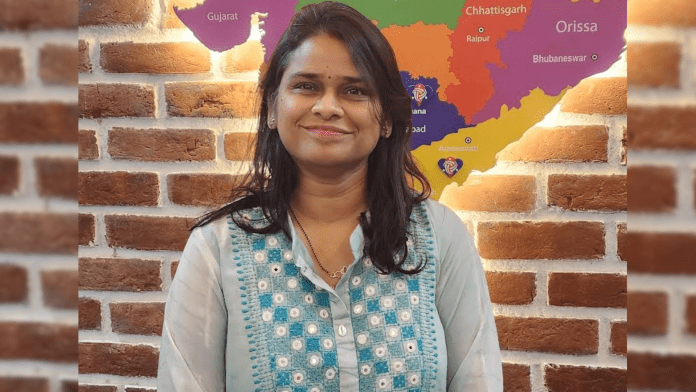

“Mumbai’s first. PAUL depuis 1889 at Phoenix Palladium,” Smita Mookherjee Rai, senior vice-president leasing- Phoenix Mills posted on Linkedin.

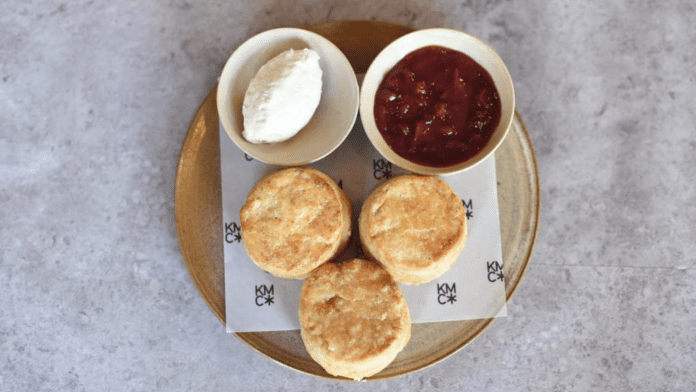

The offerings encompass an array of delectable items such as pastries, cakes, croissants, sandwiches, quiches, tarts, crepes, eggs, and an extensive selection of over 140 varieties of bread. Additionally, their menu features an assortment of beverages including tea, wine, soft drinks, and various coffee-based drinks.

Established in 1889, Paul stands as a renowned French bakery chain with a global presence. In India, Paul Bakery Café was introduced by Stellar Concept Pvt. Ltd. through its affiliated entity, Cogent Hospitality Pvt. Ltd., in 2019. Presently, the chain boasts five establishments across India, situated in prominent locations including Ambience Mall in Gurugram, Ambience Mall in Vasant Kunj, One Horizon in Gurugram, Select Citywalk in Saket, New Delhi, and the recently inaugurated outlet in Mumbai.

Phoenix Palladium forms a integral component of The Phoenix Mills Ltd., a distinguished company in India known for its preeminent focus on retail-centric mixed-use developments. This enterprise is spearheaded by Atul Ruia, who holds the position of Managing Director at The Phoenix Mills Ltd. Their footprint spans multiple cities across the nation and encompasses diverse assets, including the likes of Phoenix Palladium in Mumbai, Phoenix Marketcity malls located in Mumbai, Pune, Bengaluru, and Chennai, Phoenix Palassio in Lucknow, Phoenix United in Lucknow and Bareilly, as well as Palladium in Chennai. The company also boasts a range of hospitality assets such as The St. Regis Mumbai and Courtyard by Marriott Agra, along with residential ventures like One Bangalore West and Kessaku in Bengaluru, and a collection of commercial properties that include Art Guild House, The Centrium, Phoenix Paragon Plaza, Phoenix House in Mumbai, and Fountainhead in Pune.