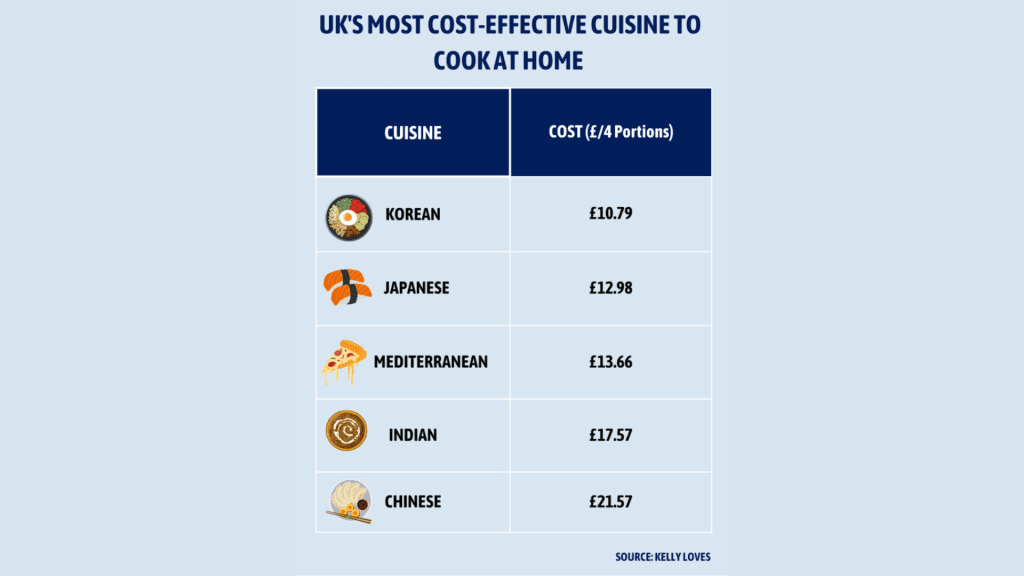

A recent research project has shown that preparing Korean food at home is the most budget-friendly option, with the average cost of a single portion being £2.69 and just £10.79 to feed a family of four. This represents a cost that is less than half of what it typically takes to enjoy popular Chinese dishes like chow mein in the UK.

The results indicated that, when preparing meals at home, Japanese cuisine is the second most economical choice, coming in at around £10.79 for a family of four. Following closely is Mediterranean cuisine at £13.66, with Indian dishes at £17.57 and Chinese cuisine at the highest cost of £21.57.

This development coincides with a significant surge in dining-out expenses due to the ongoing cost of living challenges. According to a recent study by the Office for National Statistics (ONS), prices at restaurants and cafes increased by 9.1% over the year leading up to September 2023, marking a rise from 8.8% reported in June.

In light of the current scenario where the average UK household allocates approximately £23 per week, equating to £1,220 annually, to takeout meals, there is a growing call for Brits to adopt the “fakeaway” trend. By doing so, they could potentially save more than £900 each year, especially when considering that the average cost of a Chinese takeaway stands at £27.28.

Conducted by the Asian snack and beverage brand Kelly Loves, the study focused on five of the most beloved dishes from popular UK cuisines. It involved an analysis of the average cost of the ingredients required to make these dishes at home.

When it comes to affordability, making pizza from scratch proved to be the most cost-effective option, at just £1.10 per portion. Following closely are Korean green onion pajeon at £1.76, Japanese yakitori at £1.97, and, lastly, the Chinese favorite, chow mein, at £2.11.

A serving of katsu curry came in at an economical £3.64 per portion, which is approximately one-third the cost of the same dish when dining at well-known Japanese restaurants like Wagamama, where it would typically set you back £9.75.

On the opposite end of the spectrum, Chinese dim sum emerged as the priciest dish at £8.14, marking an eightfold increase in cost compared to pizza. This was followed by Chinese kung poa chicken at £6.95, the Indian classic lamb rogan josh at £6.58, and the Greek favorite moussaka at £5.70.

Kelly Choi, Founder of Kelly Loves, says, “For those looking to cut costs, popular Korean dishes such as fried chicken, pajeon, bibimbap, tteokbokki and bulgogi are the dishes to create at home if you’re looking at cost-saving options without compromising taste, flavour and variety. Most Korean dishes are simple – based on rice and vegetables, accompanied by meat or seafood, which can be budget-friendly if you compare supermarkets and visit your local food markets.

“Korean food mainly relies on spices and seasoning which give it its unique and well-known flavour. For example, sesame oil, soy sauce, salt, garlic, ginger, gochujang and kimchi are all well-known for their distinctive taste. All of these, once in the cupboard, can be reused frequently.

Korean culture places a lot of importance on sharing food. In Korea, banchan (Korean side dishes) sharing is a feature on the table at mealtimes and so meals are naturally more communal and therefore cost-effective. Every Korean dining table looks like there is a party taking place — full of variation and colour.”