Samosa Singh, a renowned Indian snack brand, has unveiled its innovative “Ready-to-Cook” samosa packs as part of its diverse lineup. Committed to extending the global allure of India’s cherished snacks, the brand is set to introduce an enticing range of Guilt-Free Samosas, adding a flavorful dimension to its traditional samosas and Indian street snacks lineup.

These samosas feature a distinctive encrusted design meticulously developed through hours of rigorous research and development by Samosa Singh. The result is a delectable fusion of pleasure with minimal fat—reduced by up to 50%. With a diverse array of over 20 flavors, including paneer tikka samosa, soya keema samosa, cheese and corn samosa, onion kachori, Punjabi aloo samosa, and more, the brand ensures a delicious variety to cater to diverse palates.

Revolutionizing the iconic samosa into a guilt-free delight, Samosa Singh’s latest creation redefines snacking by harmonizing authentic flavors with health-conscious choices. The Guilt-Free Range ensures a complete absence of cholesterol, trans fat, preservatives, or additives, presenting an outstanding option for consumers prioritizing their health.

The ready-to-cook samosas provide a range of cooking options, including baking, deep-frying, or air-frying, carefully curated to allow consumers to savor these delightful treats in accordance with their preferences.

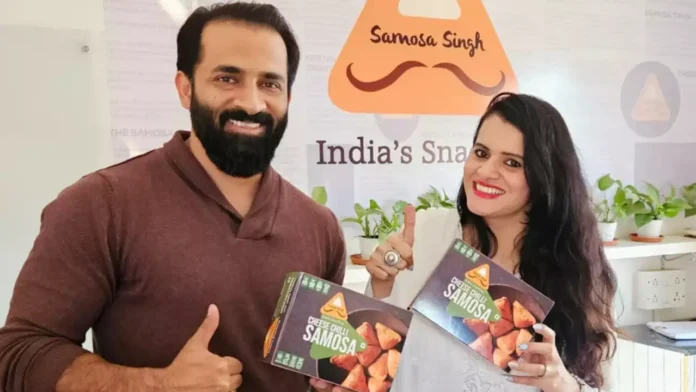

Speaking on the launch, Shikhar Veer Singh, Founder, Samosa Singh said, “We are excited to extend our product portfolio with the launch of ready-to-cook samosas, now available for a global audience. With over 100,000 hours dedicated to research and development, we are delighted to provide guilt-free enjoyment that flawlessly blends traditional flavors with a modern twist. Samosa Singh is taking the experience of India’s famous samosas to new and larger heights.”

Nidhi Singh, Co-Founder of Samosa Singh, said, “We have entered this space with the intention to provide healthier yet indulgent alternatives, revolutionizing the way people view cooking snacks. Recognizing the broad demand for ready-to-cook products in India and around the world, our mission is to redefine efficiency and inspire more people to cook at home daily. Our varied selection includes alternatives for baking, deep-frying, and air frying, appealing to various tastes. With this unique range, we hope to make meal preparation a seamless and joyful experience for our consumers.”

Continue Exploring: Samosa Singh launches new outlet in Hyderabad, expands reach with diverse culinary offerings