ITC Limited, a prominent player in the Fast-Moving Consumer Goods (FMCG) sector, is harnessing the power of Artificial Intelligence (AI) to enhance its product range by gaining valuable insights into emerging consumer trends. Additionally, the company is strategically integrating technology across its entire product value chain.

Under pilot runs for its dairy business, the company is leveraging AI tools to assess the health of cows and employing technologies to verify the authenticity of products through the provision of detailed product report cards to consumers.

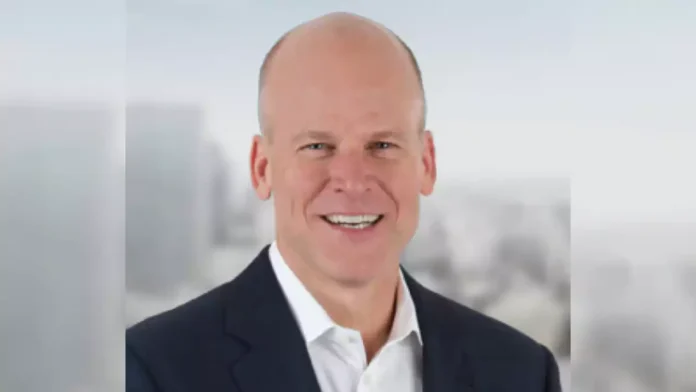

Sanjay Singal, Chief Operating Officer for the Dairy & Beverages cluster of ITC’s Foods, said, “Our consumer data hub is powered by AI engines to segment consumers at scale and understand their needs. ITC’s Sixth Sense which is our sensing engine has a team that listens to social conversations and gathers insights for all our brands. They are using AI tools to generate contextual communication for our brands. There are applications that we are yet to deploy that can provide the farmer with the health of the cows using simple AI tools. The farmer can take a picture of the cow, and scan it and it will provide information on any disease or malnutrition of the cow. We are yet to roll out the application. The company is utilizing digital technologies starting from the source.”

Continue Exploring: ITC ramps up cloud kitchen operations, targets major Indian cities

The company delivering fresh milk and dairy products under the Aashirvaad Svasti brand employs thorough digital checks to assess the quality of the milk and detect any potential adulteration.

“Our fresh dairy business is in East India including Bihar, West Bengal and Jharkhand. We do not have organised farms for milk and work with nearly 13,000 farmers from whom we buy milk twice daily. We use technology wherein when the farmer comes to the village procurement centre to sell milk, we use equipment to test the basic features of the milk. We track the transport of the milk live by maintaining a temperature of four degrees throughout the supply chain from the village to the factory. To address the concern of adulteration, we have provided codes and a WhatsApp number on the milk packets wherein once entered the consumer can get the report card on the quality of the milk,” he said.

The Kolkata-based FMCG maker, recognized for its Aashirvaad brand of organic Ghee, is introducing a virtual tour of the farms. This initiative enables consumers to witness the manufacturing process of their products through an engaging online experience.

“We introduced Aashirvaad Svasti’s Organic Ghee and were clear that organic is the way to go. We went across the country to get authentic organic butter and organic milk to make ghee. The consumers are provided with a QR code on the product which when scanned will give a virtual tour of the organic farm. The customers can see the health of the cows, and what the cows are fed. There are no fertilizers used in growing the fodder for the cows and no chemicals used in the cleaning process. The entire process can be seen through the virtual farms,” added Sanjay Singal.

Additionally, the company presents an organic selection of Aashirvaad atta, giving consumers the choice to verify the specific farm from which the batch of wheat was sourced and subsequently transformed into atta.

Continue Exploring: ITC aims for double-digit market share in smoothies and milkshakes, expanding reach beyond airports