On Thursday, Thampy Koshy, the MD & CEO of the government-backed Open Network for Digital Commerce (ONDC), said that the platform currently hosts approximately 300,000 merchants and is expected to multiply in the coming year.

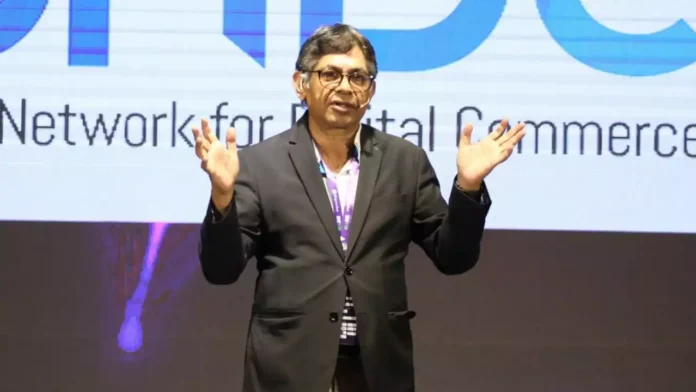

“We started with 600 merchants on-board in January last year. At present there are around 3 lakh merchants (on-boarded). In the coming year we expect this will be multiplying and build its momentum. At least ten times growth I expect in the coming year,” Koshy said during an event.

He added that in January, ONDC recorded 6.7 million transactions, and he anticipates a monthly transaction growth of 20-30 percent moving forward.

Koshy was addressing the audience following the signing of an agreement between QCI and ONDC during the launch of the DigiReady Certification (DRC) portal.

For the DRC initiative, QCI and ONDC aim to assess and certify the digital readiness of MSME entities. With the help of an online self-assessment tool, MSMEs can evaluate their preparedness to seamlessly onboard as sellers on the ONDC platform, thereby expanding their digital capabilities and business potential.

Continue Exploring: In a first, fair price shops join ONDC platform for digital transformation

“It is a way of helping people to be ready so that they can join the network as fast as possible. We are expecting that thousands of them will come onboard,” Koshy said.

Jaxay Shah, Chairperson of the Quality Council of India (QCI), said, “The launch of the DRC portal marks a pivotal moment in our mission to empower MSMEs and make e-commerce more inclusive and accessible.”

ONDC is an initiative of the commerce and industry ministry aimed at creating a facilitative model to help small retailers take advantage of digital commerce.

It’s not an application, platform, intermediary, or software; rather, it comprises specifications crafted to promote open, unbundled, and interoperable networks.

Continue Exploring: ONDC disrupts food delivery landscape: 50,000 restaurants join platform, challenging Zomato and Swiggy dominance