Tata Sons, a diversified conglomerate, is planning to infuse around $1 billion into its digital arm Tata Digital over the next few years.

This development comes days after the parent company of the Tata Group decided to pause external fundraising for Tata Neu, the ecommerce entity housing the superapp.

In October last year, Tata Group deliberated on an additional investment of $1 billion in its super app Tata Neu.

Tata Sons has invested more than $2 billion in Neu so far and has board approvals for further capital infusion over five years, as reported by ET, citing sources familiar with the matter.

In 2022, Tata Digital increased its authorized share capital from INR 15,000 crore to INR 20,000 crore with the objective of obtaining additional funds from Tata Sons. During the same year, Tata Sons injected INR 5,882 crore into Tata Digital.

The move coincides with the company’s review of its digital strategy following the recent appointment of a new CEO earlier this week. As per the report, Tata Digital will only tap external investors after the new CEO sets down to focus on execution and scale.

This development occurs against the backdrop of a series of departures at the senior level within Tata Digital. Recently, the company witnessed the resignations of Pavan Podila, its chief software architect, and Samir Aksekar, the chief information security officer.

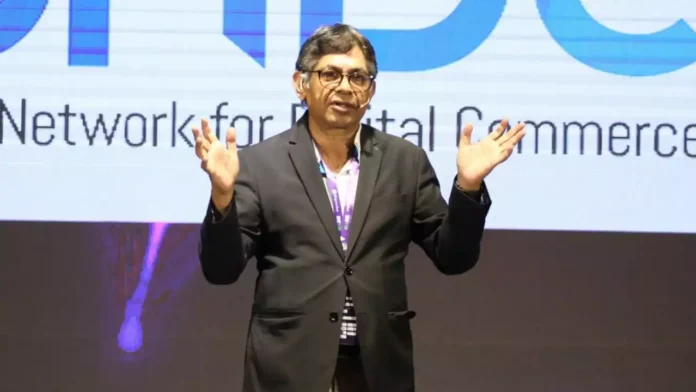

Meanwhile, Naveen Tahilyani has been appointed as the new CEO and MD of Tata Digital.

Continue Exploring: Tata Digital appoints Naveen Tahilyani as new CEO and MD amidst top-level reshuffle

In October 2023, Rajiv Subramanian, the head of Tata Neu’s travel division at the time, resigned from his role. Preceding his departure, other senior executives such as Prateek Mehta and Sharath Bulusu also left the company.

This development also comes as Tata Neu prepares to enter the online food ordering service through the open network for digital commerce (ONDC) route.

Continue Exploring: Tata Neu joins online food delivery race through ONDC integration, posing competition to Zomato and Swiggy

Introduced in April 2022, Tata Neu draws inspiration from China’s Alipay and WeChat by consolidating various services, including hotel and flight reservations, grocery and electronics shopping, and pharmaceuticals, under one umbrella.

Nevertheless, the app’s launch was marred by numerous glitches, poor user experience, and various challenges. Since then, it has failed to gain significant momentum and has yet to establish a noteworthy presence in the market.

In the meantime, Tata Digital saw its consolidated net loss soar by 5.6 times year-over-year to INR 3,052 Cr in FY22, despite a tripled year-over-year income of INR 16,201 Cr during the same period.