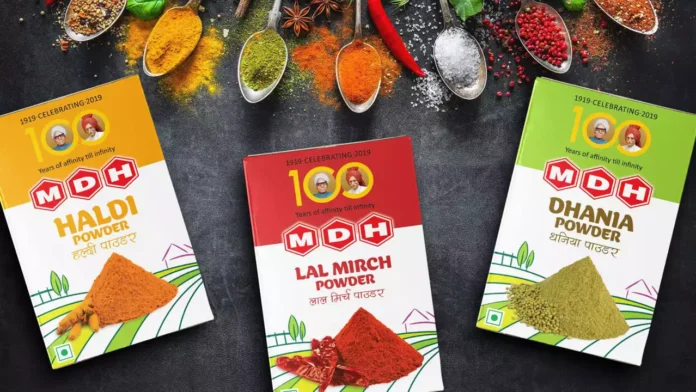

Nearly one-third of shipments from Mahashian Di Hatti Pvt Ltd (MDH) have allegedly been declined by the United States since October 2023 due to concerns over salmonella contamination, as reported by the Indian Express.

The report asserts that in 2022, US customs authorities refused entry to approximately 15 percent of MDH shipments, a figure that escalated to nearly 31 percent in 2023. Furthermore, in 2023, the US Food and Drug Administration (FDA) initiated a recall of Everest Food Products after a positive Salmonella test.

The report comes amidst actions taken by Singapore and Hong Kong authorities on Indian spice brands, including MDH and Everest, over the presence of the cancer-causing pesticide ethylene oxide in multiple spice mixes.

On April 5, The Centre For Food Safety of The Government of the Hong Kong Special Administrative Region revealed that several spices contained ethylene oxide in three spice blends from MDH Group – Madras Curry Powder, Sambhar Masala Powder, and Curry Powder.

Continue Exploring: Singapore recalls Everest’s Fish Curry Masala due to high pesticide levels

As part of its regular Food Surveillance Programme, the CFS obtained the aforementioned samples from three retail locations in Tsim Sha Tsui, respectively. The test results showed that ethylene oxide, a pesticide, was present in the samples. In a statement, the CFS stated that it had notified the affected suppliers of the abnormalities and given them instructions to cease sales and remove the impacted products from the shelves.

The report additionally notes that pesticide contamination was found in the Fish Curry Masala from Everest Group.

Last week, Singapore also initiated similar measures against Everest, asserting that the levels of ethylene oxide surpassed the permissible limits.

The International Agency for Research on Cancer has designated ethylene oxide as a Group 1 carcinogen. There are significant health hazards associated with this classification, one of which being an increased chance of breast cancer.

As per the US Food and Drug Administration (FDA), Salmonella comprises a group of bacteria responsible for causing gastrointestinal illness and fever, known as salmonellosis.

Continue Exploring: US FDA probes contamination allegations in Indian spices MDH and Everest

As stated by the Centers for Disease Control and Prevention (CDC), Salmonella naturally resides in the intestines of animals and can be present in their feces. If humans come into contact with salmonella-infected animals or items in their surroundings, the bacteria can spread to them.

According to the CDC, individuals infected with Salmonella may experience symptoms such as diarrhea, fever, and stomach cramps. Certain populations, including children under 5 years old, adults over 65 years old, and individuals with weakened immune systems, may face more severe illness, necessitating medical attention or hospitalization.