With the goal of becoming an all-foods brand, Eastern, a leading spice brand, has unveiled a new line of ready-to-cook Kerala breakfast products.

The͏͏ newly͏͏ launched͏͏ products͏͏ include͏͏ Puttu,͏͏ Palappam,͏͏ Ghee͏͏ Upmavu,͏͏ Dosa,͏͏ Idli,͏͏ and͏͏ Idiyapam.͏͏ Each͏͏ of͏͏ these͏͏ can͏͏ be͏͏ prepared͏͏ in͏͏ just͏͏ five͏͏ minutes͏͏ while͏͏ retaining͏͏ the͏͏ authentic͏͏ taste͏͏ of͏͏ Kerala.

Catering͏͏ to͏͏ Modern͏͏ Consumers’͏͏ Breakfast͏͏ Needs:

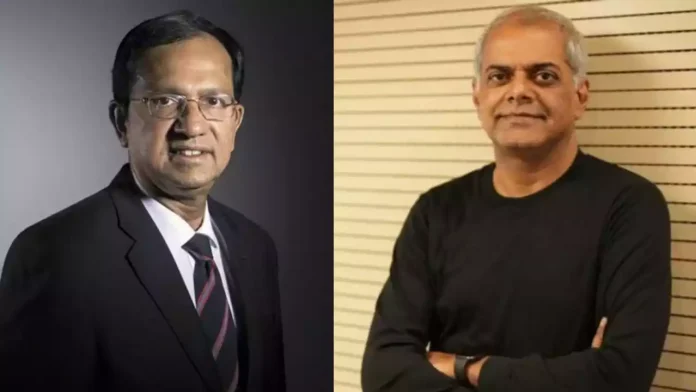

Sanjay͏͏ Sharma,͏͏ CEO͏͏ of͏͏ Orkla͏͏ India,͏͏ stated͏͏ that͏͏ these͏͏ products͏͏ are͏͏ part͏͏ of͏͏ Keralites’͏͏ breakfast͏͏ preferences,͏͏ offering͏͏ consumers͏͏ a͏͏ convenient͏͏ way͏͏ to͏͏ prepare͏͏ their͏͏ traditional͏͏ morning͏͏ meals.

Feedback͏͏ from͏͏ the͏͏ trial͏͏ run͏͏ was͏͏ positive,͏͏ with͏͏ modern͏͏ consumers͏͏ expressing͏͏ a͏͏ preference͏͏ for͏͏ these͏͏ products͏͏ over͏͏ traditional͏͏ breakfast͏͏ preparation,͏͏ which͏͏ often͏͏ requires͏͏ advance͏͏ planning,͏͏ cooking͏͏ skills,͏͏ and͏͏ more͏͏ time.

However,͏͏ consumers͏͏ who͏͏ frequently͏͏ prepare͏͏ these͏͏ dishes͏͏ at͏͏ home͏͏ indicated͏͏ that͏͏ they͏͏ seek͏͏ time-efficient͏͏ solutions͏͏ and͏͏ wish͏͏ to͏͏ reduce͏͏ their͏͏ time͏͏ spent͏͏ in͏͏ the͏͏ kitchen.

Continue͏͏ Exploring:͏͏ Orkla͏͏ India͏͏ Appoints͏͏ Murali͏͏ S͏͏ as͏͏ CEO͏͏ of͏͏ Eastern spice͏͏ and͏͏ masala͏͏ brand

Growth͏͏ Potential͏͏ in͏͏ Breakfast Segment:

Sharma͏͏ noted͏͏ that͏͏ the͏͏ organized͏͏ segment͏͏ for͏͏ breakfast͏͏ food͏͏ products͏͏ is͏͏ valued͏͏ at͏͏ around͏͏ INR͏͏ 400͏͏ crore,͏͏ and͏͏ the͏͏ company͏͏ aims͏͏ for͏͏ considerable͏͏ growth͏͏ in͏͏ this͏͏ area.͏͏ However,͏͏ it͏͏ has͏͏ opted͏͏ for͏͏ a͏͏ cautious͏͏ and͏͏ steady͏͏ approach͏͏ to͏͏ gain͏͏ market͏͏ acceptance.

All͏͏ the͏͏ products͏͏ have͏͏ a͏͏ shelf͏͏ life͏͏ of͏͏ six͏͏ months͏͏ and͏͏ are͏͏ competitively͏͏ priced.͏͏ The͏͏ MRP͏͏ for͏͏ Idiyappam͏͏ (200͏͏ grams)͏͏ is͏͏ INR͏͏ 99,͏͏ while͏͏ Dosa,͏͏ Idly,͏͏ Palappam,͏͏ and͏͏ Puttu͏͏ are͏͏ all͏͏ priced͏͏ at͏͏ INR͏͏ 69͏͏ each.

Leading͏͏ the͏͏ Spice͏͏ Market͏͏ in͏͏ Kerala:

Eastern͏͏ leads͏͏ the͏͏ pure͏͏ spices͏͏ and͏͏ masalas͏͏ market͏͏ in͏͏ Kerala,͏͏ boasting͏͏ over͏͏ 45͏͏ percent͏͏ market͏͏ share.͏͏ “We͏͏ play͏͏ a͏͏ vital͏͏ role͏͏ in͏͏ consumers’͏͏ daily͏͏ meals͏͏ for͏͏ lunch͏͏ and͏͏ dinner͏͏ and͏͏ aim͏͏ to͏͏ be͏͏ present͏͏ at͏͏ every͏͏ food͏͏ occasion,”͏͏ he͏͏ stated.͏͏ Additionally,͏͏ the͏͏ company͏͏ is͏͏ targeting͏͏ upcountry͏͏ and͏͏ international͏͏ markets͏͏ to͏͏ showcase͏͏ authentic͏͏ Kerala͏͏ flavors.

Manoj͏͏ Lalwani,͏͏ Chief͏͏ Marketing͏͏ Officer,͏͏ stated͏͏ that͏͏ Eastern,͏͏ with͏͏ its͏͏ 40-year͏͏ legacy,͏͏ has͏͏ a͏͏ strong͏͏ market͏͏ connection͏͏ and͏͏ a͏͏ deep͏͏ understanding͏͏ of͏͏ authentic͏͏ Kerala͏͏ cuisine.͏͏ Recent͏͏ market͏͏ research͏͏ revealed͏͏ that͏͏ Keralites͏͏ have͏͏ a͏͏ strong͏͏ preference͏͏ for͏͏ their͏͏ traditional͏͏ breakfast,͏͏ which͏͏ they͏͏ regard͏͏ as͏͏ the͏͏ ideal͏͏ way͏͏ to͏͏ start͏͏ the͏͏ day.

In͏͏ 2021,͏͏ Norwegian͏͏ conglomerate͏͏ Orkla͏͏ acquired͏͏ Eastern͏͏ via͏͏ its͏͏ Indian͏͏ subsidiary,͏͏ MTR͏͏ Foods.