KRBL Ltd, the company behind the popular ‘India Gate’ basmati rice brand, is expanding its product portfolio to include mixed spices and rice bran edible oil.

India Gate aims to introduce outlets in FY26

The company has already launched its mixed biriymasala on e-commerce platforms and plans to introduce it in brick-and-mortar stores next financial year.

Continue Exploring: India’s Gen Z prefers healthy, natural skin over fairness obsession – L’Oreal CEO

According to ET, “It is already on e-commerce platforms for a year now. Now we are planning to launch it in brick-and-mortar general stores. Looking at the success of biriyani masala, we are actually creating a range of masalas, for premium market. We will launch it in the first quarter of next financial year. We will be in the spice mix category, because consumer convenience is a factor,” said one of the top management officials.

The company is also entering the edible oil market with the launch of rice bran oil in January. “It is a category where we can add value. In January, we are planning to launch it. We already produce unrefined rice bran oil at our plant, and it is a logical conclusion to process and retail it. Our retail network ecosystem in a way will complement it,” the top management said further.

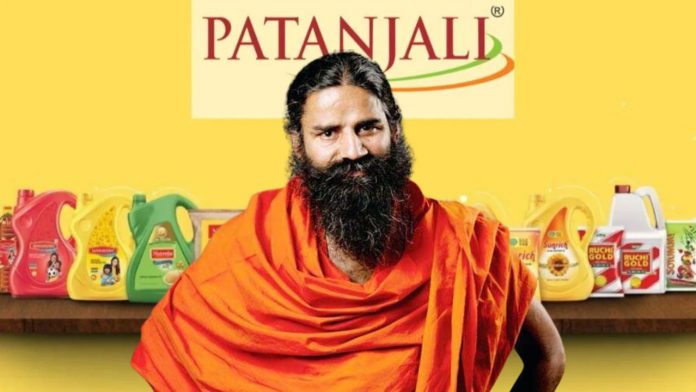

Continue Exploring: Patanjali Ayurveda reports fivefold profit surge to INR 6,460 Cr despite sales decline

India Gate has become synonymous to rice provider – KRBL ltd

Further, the company believes that its India Gate brand will work in its favour as it expands into new product categories. “In 30 years, we have made such a strong brand. India Gate has become synonymous to a rice provider… Atta, spices, edible oils, and pulses are all logical extension that we see in the brand India Gate,” the top management stated.

However, KRBL is also optimistic about its basmati rice business, with the government removing the floor price on export of Basmati rice in September this year. The company has set a record paddy procurement target this season and is expecting higher exports compared to last year. “We are looking at higher export as compared to last year,” said Kunal Gupta, Head Dhuri Plant. The company is in the process of procuring about a million tonnes of paddy from farmers and is forecasting a good year.