In July, Delhi-based tea brand Vahdam India expanded its presence to more than 4,000 CVS Health Stores in the United States. Founder Bala Sarda asserts that this retail expansion is a logical step forward, given Vahdam’s digital presence in the US since its establishment in 2015.

Mumbai-based Skillmatics, supported by PeakXV (formerly known as Sequoia Capital India), is experiencing a comparable journey. The company is marketing its educational games for children through online channels and in over 15,000 stores within US-based retail chains such as Walmart, Target, and Hobby Lobby.

The Ayurveda Experience, initially established in 2014 as a platform for Ayurveda content, has expanded its operations to include the sale of serums and cleansers in the US and Australia. Additionally, Skin Elements, specializing in men’s hygiene products, generates over 60 percent of its revenue through sales in the US.

In the past twenty years, India has earned recognition as a primary provider of backend technical support for numerous American multinational corporations. It has also established itself as one of the premier global providers of software services, with notable contributions from companies like Freshworks and Zoho, among other Software as a Service (SaaS) platforms.

However, Indian brands have not achieved the same level of dominance in the American consumer market as US brands have in India, spanning from food and clothing to personal care. Whether it’s Levi’s and McDonald’s or Cetaphil, every individual residing in India frequently engages with American brands.

“But it was only a matter of time before the trend of selling service from India to the world came for consumer brands,” says Vinay Singh, co-founder and partner, Fireside Ventures.

Certainly, brands such as Himalaya and Dabur have been active in international markets for several decades. Himalaya, for instance, established its initial international office in Houston, Texas, in 1996 and inaugurated its first brand store in the Cayman Islands in the same year.

“Indian papad and bhujiya companies have also been selling internationally through India food stores for many years now,” says Mohit Satyanand, an angel investor.

However, it took Himalaya nearly 66 years to expand internationally, whereas contemporary Indian consumer brands aspire to sell to American consumers right from the inception of their businesses.

Ayushi Gudwani, the founder of the clothing brand Fable Street, asserts that her company has been shipping products internationally since approximately the second month of its establishment in 2017.

This phenomenon can be attributed to technological advancements in the consumer shopping category and digital marketing, which can commence with an investment of approximately a thousand dollars.This phenomenon is a result of technological advancements in consumer shopping and digital marketing, which can start with an investment of approximately a thousand dollars.

“To start a brand, you need a place to sell, a distribution channel and someone who can take your products to the consumers,” says Dhvanil Sheth, founder, Skillmatics (Grasper Global Pvt Ltd).

E-commerce marketplaces and seller platforms like Etsy address these requirements. Channels such as social media platforms and one’s website can be utilized for brand-building and addressing advertising needs, while courier partners handle the delivery aspect.

In the past decade, many modern brands, including the recently listed Honasa Consumer Pvt Ltd, the parent company of Mamaearth, and Boat Lifestyle, began their journey on Amazon and other digital marketplaces.

But isn’t it still challenging to appeal to American consumers, who are not only enticed by domestic companies but also by firms from France, Britain, Israel, and China?

So far, Indian brands that have found success in the US have some form of differentiation.

“Any category or product, which is known to be India’s specialty, has a consumer base in international waters. India is known for silk, indigo, teas and handicraft, among many other things,” says Singh of Fireside Ventures. Just like South Korea is associated with electronics and Japan with matcha tea.

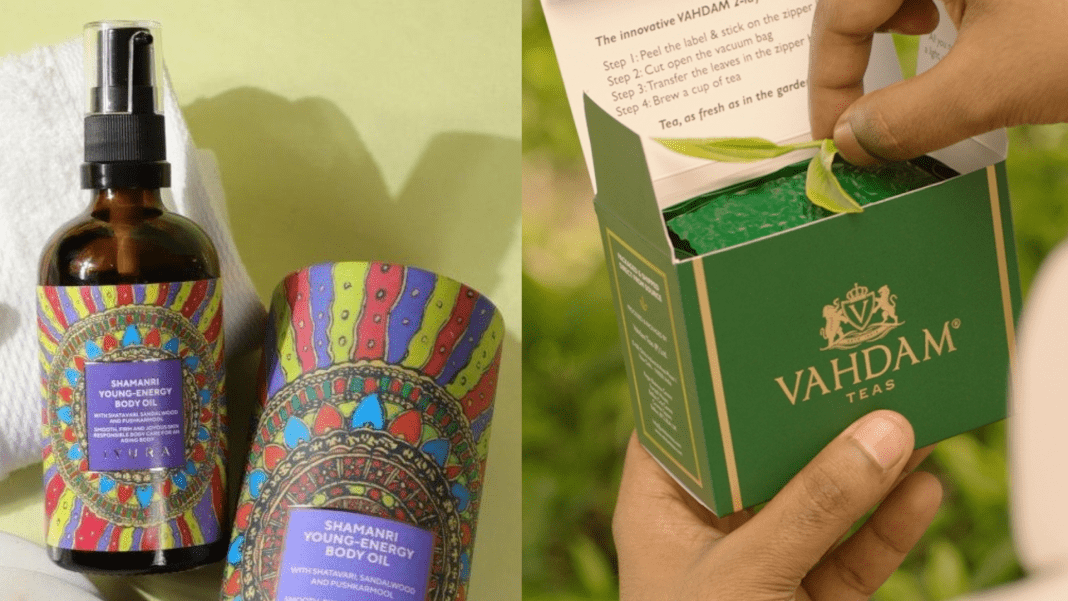

While The Ayurveda Experience introduces Ayurvedic products, Vahdam India’s offering revolves around locally sourced, high-quality tea from India.

However, companies could also venture into a category with potential for growth. Raghav Sood, the founder of Skin Elements, asserts that when he introduced his men’s intimate hygiene wash, the category did not exist on Amazon’s domestic and US websites.

Likewise, Jyoti Bharadwaj, the founder of TeaFit, identified a void in the unsweetened beverage segment in India and is currently exploring the international tea-drinking market in Singapore and New Zealand.

“There should be a real differentiation and not a perceived differentiation in your product,” explains Skillmatics’ Sheth. This means having a similar product as another brand and selling it for cheaper cost would not suffice in the American consumer market.

Pricing is a crucial aspect to take into account when selling in the US. Nevertheless, more than half a dozen founders of consumer brands assert that quality should always take precedence over everything else.

“People in the US are quality sensitive,” claims Sood. If the consumer is satisfied with the product, it can also be priced at a premium.

For example, Skillmatics’ game called Space Explorer is priced at INR 664 ($7.97) on Amazon India, whereas the same game is listed on the platform’s US website for $24.99 (INR 2,082). Similarly, Vahdam’s lemon ginger tea, comprising 50 tea bags, is available for INR 374 ($4.5) in India, while it is sold on the brand’s US website for $24.99 (INR 2,082) for 100 tea bags.

Production costs in India are lower, and the rupee is weaker in comparison to the dollar. As a result, the pricing may appear elevated when compared in rupees to the US dollar.

In India, the market is highly price-sensitive, with consumers being willing to switch brands even for a slight increase in pricing if the competitor’s product is slightly cheaper.

Furthermore, the products must align with American sensibilities. During the initial years, Sheth enlisted the services of US-based agencies to assist in developing the first few SKUs (stock keeping units). Vahdam India concurrently expanded its online distribution channel to gauge the reception of its tea among American consumers and determine what resonates.

Adopting a strategy of undercutting on price is not advisable solely based on the lower manufacturing costs in India.

“Your company is manufacturing in India. So, maybe your production cost is cheaper. But there is another company, which is manufacturing from China,” adds Sheth.

“When it comes to products, the US market is not driven by emotions but by facts,” says Sujata Biswas, co-founder of Suta, a sari brand.

Consumers prefer companies to be straightforward and highlight the functionality of the product rather than relying on sentimental slogans like ‘Desh ka namak,’ as seen in Tata Salt’s slogan. If Suta were to launch an advertising campaign in the US, it would focus on the convenience of wearing saris and the quality of the fabric, Biswas further explains.

The self-funded sari brand has established a presence in the US by selling through individual stockists. The company is actively seeking collaborations with US-based companies to navigate the nuances of the new market. Due to the unclear regulations, the founders are utilizing courier partners, including DHL Express, to facilitate the shipping of their products to the US.

“Courier partners get the paperwork sorted for sellers looking to export to the US or the UK,” says Muskaan Sancheti, founder, The State Plate. The four-year-old ethnic snack platform started selling products internationally two months ago and claims the largest number of orders as of now have come from the US.

To establish a reputable brand in the US, a company must comply with specific rules and regulations and obtain various licenses. For example, in the food and beverages category, acquiring a Food and Drug Administration (FDA) license is essential. Additionally, an import-export license is required, according to Chirag Gada, Vice President (New Businesses) at Think9 Consumer. Founded in 2022 by Ashni Biyani, Think9 Consumer Pvt Ltd has adopted a house of brands strategy, acquiring multiple brands to expand its presence beyond India.

According to at least four founders overseeing their brands in the US, it’s imperative for a company to have a few team members working locally. Presently, Vahdam India, Skillmatics, and The Ayurveda Experience have on-site teams in the US.

“If you are trying to build a brand for the American consumers, you would need to have a marketing team there to understand the market’s nuances,” says Sarda of Vahdam.

As an example, Vahdam might introduce a Halloween tea collection, considering it is a popular festival in the United States. The company could also release testimonials from well-known personalities like Ellen DeGeneres and Oprah Winfrey, who hold popularity in the country.

Similarly, Skillmatics advertises its products with American kids. “If you see our website and social media, no one would be able to say that this brand comes from India,” says Sheth. “We are currently doing Rs400 crore in revenue. At this stage, we have to expand in retail.”

Having a local logistics team can assist in determining the optimal retail route and deciding whether the products should be shipped by air or sea.

“A company’s cost can also inflate quickly if they do not get the air-to-sea export ratio right,” adds Gada.

According to Jatan Bawa, co-founder of Perfora, approximately one-tenth of the cost, when a product is sold for $100, is attributed to air shipping. The two-year-old oral care brand commenced selling in the US through Amazon international.

“It is too soon to talk about numbers. But we want to get better volumes so that we can start shipping by sea,” says Bawa.

The customer acquisition cost (CAC), a significant expense for digital-first brands in India, can also be a significant drain on cash in the US.

“The cash burn becomes even more expensive there because the spends are in dollars,” says Rishabh Chopra, founder, The Ayurveda Experience. Similarly, hiring a full-time US-based team is also an expensive affair as salaries are paid in dollars.

However, getting into brick-and-mortar stores is the only way to achieve the required volumes, potentially leading to improved unit economics.

“It is difficult to pinpoint how much a brand would earn and what volumes are required because every category has its own play. There is no formula or one-size-fits-all kind of approach,” says Think9’s Gada.

The sole logical progression for brand development in the US is to expand offline. A local operations team is essential for initiating offline expansion. Currently, Vahdam India has a presence in over 6,500 stores in the US, UK, Canada, and the UAE, and Skillmatics is available in over 15,000 stores in the US and the UK. However, Fireside Venture’s Singh asserts that these numbers are relatively small.

“Instead of thinking of store count, a brand should focus on figuring out how it can increase its presence across various retail chain formats,” he adds.

According to Singh, successfully expanding into retail stores means being present in over 4,000 stores, considering Walmart has a total of 4,623 stores in the US.

Over 50 percent of India’s retail market is unorganized, predominantly managed by kirana stores. In contrast, in the US, 90 percent of retail is overseen by organized chains such as Walmart, Target, Walgreens, Costco, and Macy’s.

Surviving in these retail stores presents another challenge.

“Getting into the US retail market is not easy. And once you do get in, your product needs to keep moving and you need to keep delivering growth in sales to the retail chain year after year. Or they will not stock your product anymore,” says Vahdam India’s Sarda.

India’s consumer expenditures have been on a consistent upward trajectory. In the quarter ending in June, consumer spending amounted to INR 23,126 billion, compared to INR 21,824 billion for the corresponding quarter in the previous financial year, as reported by the research firm Statista.

FableStreet, the fashion brand, has opted to concentrate on the Indian market, recognizing its potential for further growth. Similarly, for Skillmatics, nearly 15 percent of revenue is derived from India, making it the fastest-growing market for the children’s brand.

Nevertheless, founders of consumer brands still aspire to venture into international markets.

“As an Indian consumer brand founder, I can definitely say that we, as a country, have not yet produced a worldwide enduring brand like a Coke or a Red Bull,” says TeaFit’s Bharadwaj. But unlike two decades ago, Indian brands are also catering to and finding product acceptance from consumers outside of the India diaspora.

“If your brand is successful in the US, you have recognition in the world’s biggest consumer market,” says Gada. This is equivalent to having global recognition, he claims.

Establishing a brand in the US is not fundamentally distinct from the process in India. Shared factors, such as digital marketing, customer acquisition costs, and strategic retail expansion, apply to both countries. Notable distinctions arise in crafting a distinctive product with exceptional quality, efficiently managing the supply chain costs, grasping consumer nuances, and navigating retail distribution while sustaining a presence in those stores.

“To be able to build a made-in-India consumer brand and find acceptance the world over is a dream of every founder… it’s also a testament to the quality of products by the brand,” says Bharadwaj.