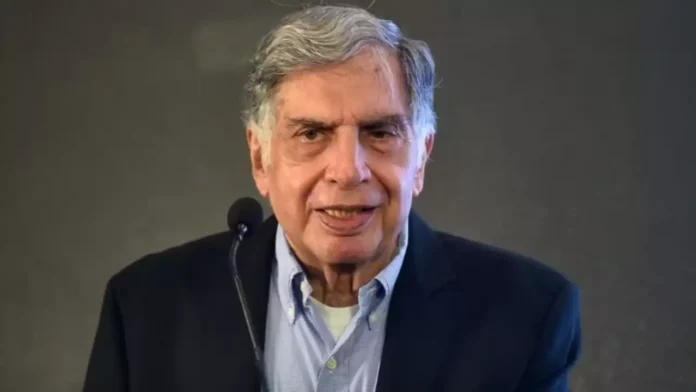

Business tycoon Ratan Tata is poised to liquidate his complete holding of 77,900 shares in the upcoming first public offering (IPO) of the FirstCry e-commerce platform. In 2016, Tata acquired a 0.02 per cent stake in Brainbees Solution for INR 66 lakh. Brainbees Solution oversees omnichannel ventures in children’s apparel under the FirstCry brand.

As per the draft red herring prospectus (DRHP) submitted to the Securities and Exchange Board of India (SEBI) by Brainbees Solutions, the parent company of FirstCry, the initial public offering (IPO) encompasses the issuance of new equity shares valued at INR 1,816 crore. Additionally, there will be an offer for sale by existing shareholders and promoters.

Current stakeholders, such as Mahindra & Mahindra (M&M), private equity firm TPG, NewQuest Asia, and SoftBank, intend to jointly divest 5.44 crore shares in Brainbees through an Offer for Sale (OFS) in conjunction with the primary issue.

SoftBank is the leading shareholder in FirstCry, holding the largest stake at 25.5 percent, establishing it as the principal stakeholder in the online e-commerce unicorn. As outlined in the document, Mahindra is set to divest its 0.58 per cent stake in the parent company, while SoftBank plans to offload 2.03 crore shares.

Continue Exploring: SoftBank to lead FirstCry IPO sell-off with up to 2 Crore shares; other major stakeholders follow suit

The draft red herring prospectus (DRHP) additionally mentioned that FirstCry is contemplating a private placement of shares to specific investors, with a potential value of up to INR 363.20 crore. FirstCry provides a range of toys, apparel, and accessories catering to babies, kids, and mothers, available both through online platforms and physical stores.

FirstCry, as per its DRHP, has not disclosed the commencement and conclusion dates for the IPO subscription. Nonetheless, various media reports suggest that the public issue is anticipated to commence in early 2024. Additionally, details regarding the offer price and IPO price band have not been unveiled at this juncture.

According to the Draft Red Herring Prospectus (DRHP), the funds generated will be allocated for establishing new retail outlets, warehouses, and facilitating international expansion. The book-running lead managers include Kotak, Morgan Stanley, BofA Securities, JM Financial, and Avendus, with Link Intime India Private Limited serving as the offer’s registrar.