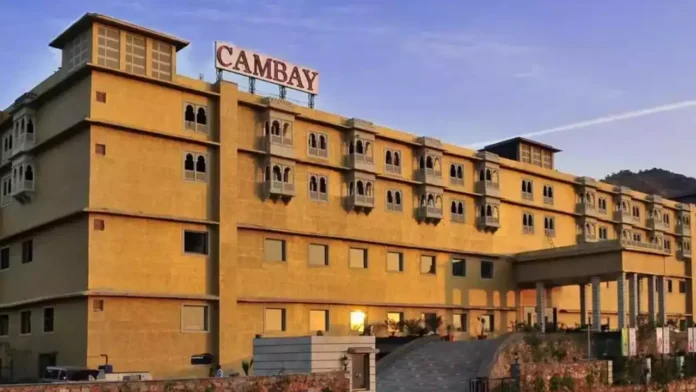

The bankruptcy court in Ahmedabad has rejected Gujarat-based Express Group of Hotels’ revival plan for Neesa Leisure Ltd, which operates a luxury hotel chain under the brand Cambay.

The company has admitted liabilities of INR 1,580 crore, whereas the resolution plan approved by the lenders proposed to give INR 150 crore to them to acquire the company through the bankruptcy process. The successful resolution applicant had proposed INR 250 crore towards capex and fresh funds, bringing the total value of the plan to INR 400 crore.

“The resolution plan approved by CoC (committee of creditors) has not been done with a process that can be approved by this adjudicating authority as it lacked a due and transparent process of examining each application on its merits,” the division bench of judicial member Chitra Hankare and technical member Velamur G. Venkata Chalapathy said in its order on March 1.

Continue Exploring: NCLT warns Dunzo of moratorium over unpaid dues worth INR 4 Cr

Prior to the rejection of the plan by the National Company Law Tribunal (NCLT), Neesa Leisure’s lenders had given their approval with a 67.5% voting majority.

“The plan has treated the secured creditors to be paid and not considered the claims of unsecured creditors when the majority of the assets are under dispute which are mainly leased properties against which these secured creditors have created exposure,” said the bench.

The insolvent company’s assets are situated in Gandhinagar and Ahmedabad in Gujarat, as well as in Neemrana, Udaipur, and Jaipur in Rajasthan.

According to Vishal J Dave, an independent counsel and insolvency consultant from Ahmedabad, the next steps in this case would involve creditors collaborating to devise a new plan, addressing the issues highlighted in the order, as some of them delve into the core of the matter.

Initially, the company entered the resolution process after Asset Reconstruction Company (I) Ltd filed an application in April 2019.

Numerous strategic buyers and investors are actively seeking hotel and resort properties undergoing bankruptcy proceedings due to loan defaults. The surge in revenge tourism following Covid-19 lockdowns has rendered the sector appealing to well-funded individuals and entities.

In January, Hemant Kanoria-promoted Sarga Hotels, which operates a five-star hotel under the Westin brand in Kolkata, was acquired by Shri Ram Multicom under the Insolvency and Bankruptcy Code (IBC) process.

Likewise, investors and strategic buyers have expressed keen interest in the resolution proceedings of Viceroy Hotels, listed on the Bombay Stock Exchange (BSE), which operates Marriott Hyderabad and Courtyard Marriott Hyderabad, as well as Mumbai-based V Hotels Ltd, the proprietor of Tulip Star, formerly recognized as Centaur Hotel Juhu.

The latest data from the Insolvency & Bankruptcy Board of India showed 7,325 companies were brought into administration until December-end last year. Of these, about 146 companies were from the hotels and hospitality sector.

Continue Exploring: NCLT grants 45-day extension for Future Supply Chain Solutions’ corporate insolvency resolution