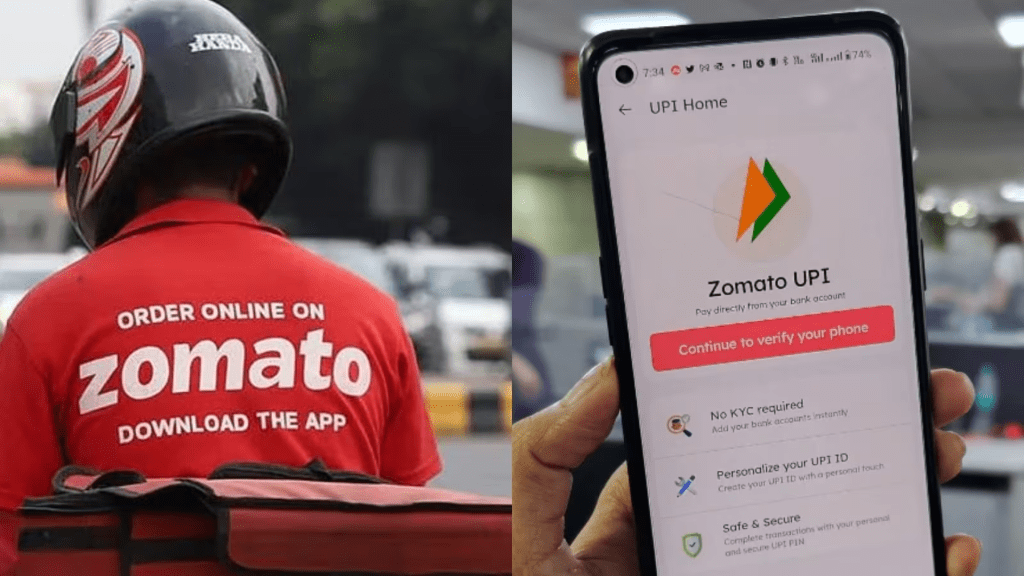

According to reports, Zomato, the foodtech startup, has temporarily halted the registration of new users for its UPI payments platform, Zomato UPI.

As per sources mentioned in an ET report, the ability to sign up for Zomato UPI has been deactivated for the past few weeks. Presently, users who haven’t registered for it prior to the temporary suspension will not see the UPI option in the Zomato app.

Zomato has collaborated with ICICI Bank to provide UPI payment services, as confirmed by the foodtech company. However, Zomato clarified that the UPI feature is currently only accessible to existing users who had already availed of it. The temporary pause in onboarding new users for the UPI service is attributed to Zomato’s intention to incorporate feedback received regarding the onboarding process, as stated by a spokesperson from the company.

“We will start enrolling new users by the end of the month,” the Zomato spokesperson added.

Zomato UPI was introduced in May as a peer-to-peer (P2P) and merchant transaction service, enabling users on Zomato’s platforms to make payments seamlessly without the necessity of switching to other apps.

In addition to facilitating online payments for food and grocery orders on Zomato and Blinkit, these foodtech platforms also provide customers with the choice to pay at select restaurants listed on Zomato. This payment flexibility is made possible through multiple options, including cards, net banking, and UPI, all accessible through Zomato Pay.

In August 2021, the foodtech platform introduced Zomato Payments, an initiative aimed at providing digital payment solutions including wallets and payment gateway services. Moreover, Zomato offers users the ability to purchase and send gift cards through its app. In the year 2022 alone, Zomato witnessed a significant increase in its customer base for food orders, with 58 million annual transacting customers compared to 49.5 million in 2021.

The foodtech giant is exploring ways to capitalize on the significant volume of traffic flowing through its platforms to stimulate a substantial increase in online payments. In the year 2022, Zomato boasted an impressive count of 58 million annual transacting users and successfully handled a gross merchandise value (GMV) surpassing $2.8 billion in the fiscal year 2022.

In response to the growing trend of tech startups venturing into the UPI (Unified Payments Interface) arena, several prominent foodtech companies have also joined the race. This development is exemplified by the efforts of various players in the industry, such as the renowned ecommerce giant Flipkart.

Zomato’s decision to introduce its own UPI service coincided with the National Payments Corporation of India (NPCI) actively seeking to expand the participant base within the ecosystem. Currently, the UPI landscape remains predominantly controlled by three major players, namely PhonePe, Google Pay, and Paytm, collectively responsible for over 95% of the regular UPI transactions.

Zomato’s remarkable comeback in the stock market continues, as its shares surged by 6% during intraday trading on Thursday (July 13). The stock reached a new 52-week high of INR 84.50 per share, showcasing the company’s impressive performance.