Ace Turtle, a startup in the retail technology space, announced on Tuesday that it has secured $34 million (INR 293 crore) in funding for its Series B round. The funding was provided by a group of investors, including Vertex Growth, SBI Investment Co. Ltd., Farglory, Lesing Nine, Stride Ventures, Tuscan Ventures, and Trifecta Capital.

The startup’s previous investors, Vertex Southeast Asia & India and InnoVen Capital, also joined in the latest funding round alongside the new investors.

Ace Turtle has announced that it intends to utilize the newly raised funds to secure long-term licenses for international fashion and lifestyle brands, as well as expand its in-house technology stack. The startup is also looking to hire skilled professionals at various levels to bolster its ambitious expansion plans.

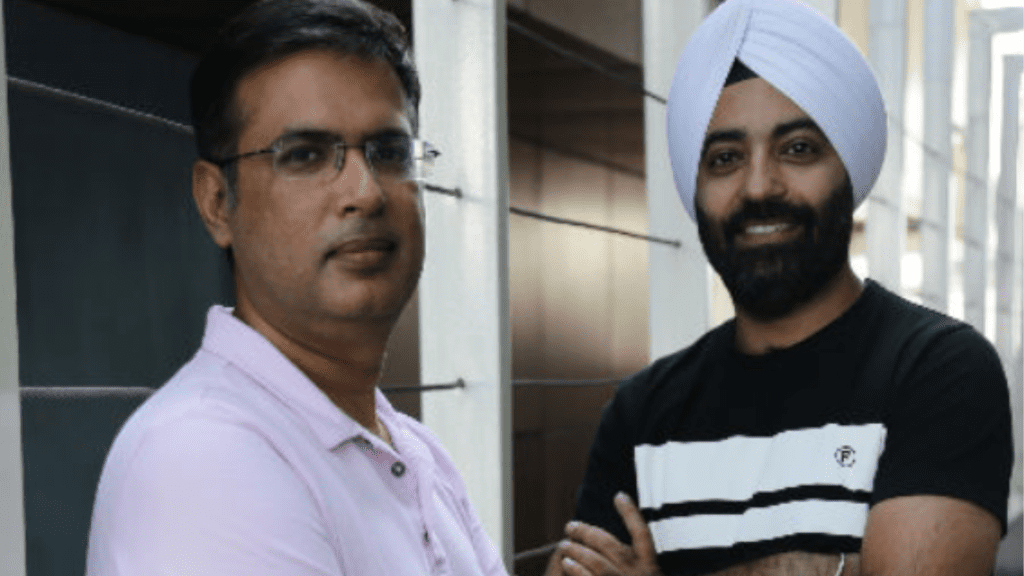

‘Our aim is to lead the next phase of retail in India and scale it to new heights through vertical commerce,” said Nitin Chhabra, CEO of ace turtle.

Ace Turtle, established in 2013 by Chabra and Berry Singh, provides comprehensive e-commerce software and operational resources to brick-and-mortar retail brands, delivering end-to-end solutions. The startup operates in two business verticals, SaaS and licensed brands.

Ace Turtle’s proprietary platform, Rubicon, is designed to seamlessly integrate online and offline retail channels and facilitate omnichannel transformation, thus enhancing efficiency and scalability for companies. Rubicon is a widely used SaaS platform by global brands. Additionally, Ace Turtle utilizes this platform for its licensed brand portfolio, which features popular names such as Wrangler, Toys”R” Us, Lee, and others.

Ace Turtle has expressed its objective to maintain the notable growth it experienced in FY23, during which its revenue doubled and it achieved positive EBITDA.

“We believe India will be a leading source of global growth in the decades ahead, supported by positive demographics, a growing middle class and deepening internet penetration. This investment in ace turtle builds on our program to provide long-term capital to innovative companies transforming industries at scale,” said Yoshitaka Kitao, Chairman and President of Japanese VC firm SBI Investment.

Ace Turtle’s pre-Series B funding round in 2019 saw the startup raising INR 27 crore.

The startup competes with the likes of Vinculum and Unicommerce.

The Indian e-commerce market’s total addressable market (TAM) is anticipated to touch $400 billion by 2030, displaying a compound annual growth rate (CAGR) of 19% from 2022. The omnichannel approach has emerged as a dominant force in this sector.

The ecommerce sector experienced a 63% year-on-year (YoY) decline in total funding in 2022, amounting to only $4 billion during the funding winter.